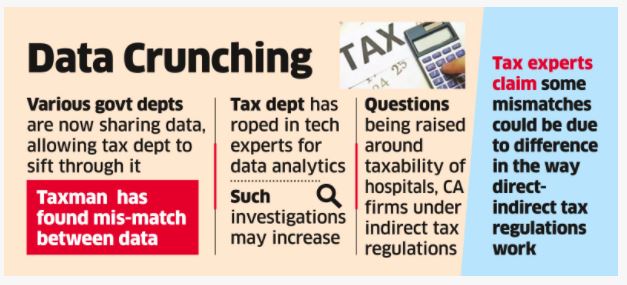

Chartered accountant firms and hospitals are under scrutiny after the revenue department found mismatches between their income tax and indirect tax filings.

Tax authorities have also decided to slot consultant doctors as ‘intermediaries’ for taxation purposes even as medical services are outside the purview of goods and services tax (GST), people aware of the development said.

The tax department has issued notices to several hospitals, they said

With the revenue department getting data from various government departments, its data analytics team can parse through large amounts of data and throw up the inconsistencies quickly.

“With the increasing sharing of data amongst the tax authorities, it is expected that several cases of data mismatches will emerge,” said MS Mani, partner at Deloitte India. “While it is essential for all businesses to respond with the relevant clarifications and reconciliations, it is also essential for the tax authorities to appreciate the fact that there could be various genuine reasons for such mismatches and consider the views put forth by businesses, before embarking on litigation,” he said.

I-T is mainly paid on an individual’s, company’s or a hospital’s revenues, while indirect taxes such as GST are paid on certain transactions.

Some experts feel that most of the tax notices issued to CA firms and hospitals are routine enquiries.

“These notices based on I-T return or indirect tax data have been issued just to meet the deadline,” said Shailesh Sheth, advocate at SPS Legal. “The notices, in majority cases, are issued mechanically and are baseless.”

Take hospitals, for instance.

Medical services provided by doctors and hospitals are exempt from GST. However, the tax department is claiming that when a visiting or consultant doctor advises a patient in a hospital, it’s more like an “intermediary” service as primary service (that’s exempt from GST) is provided by the hospital already.

Some legal experts are questioning this rationale.

“While hospitals render exempt services to patients, the tax authorities seem to have taken an interpretation that visiting or consulting doctors are intermediaries,” said Abhishek A Rastogi, partner at Khaitan & Co. “As a corollary, the moot point of taxability arises when doctors work on behalf of hospital for offering such medical services within a hospital.”

Legal experts say this in a way also means that the same doctor providing service to the same patient may have different tax implications.

As per the rationale, a transaction will attract GST if the doctor is sitting within a hospital and won’t if the doctor isn’t, they said.

“When same services are offered outside a hospital directly to patients is presumably outside GST, thereby inviting complications and litigation,” Rastogi said.