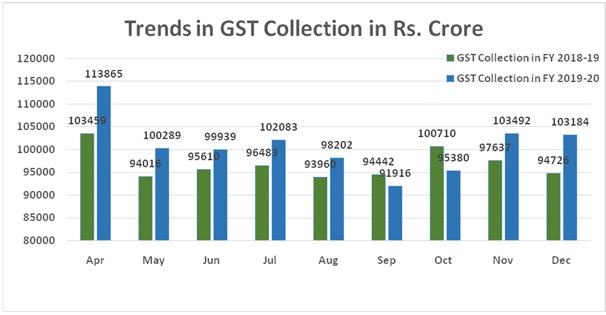

Considering the difficulties faced by trade and industry in filing of returns, the government has decided to introduce several measures to ease the process. The Finance Ministry today said that now GST taxpayers can file their GSTR-3B returns in a staggered manner. Presently the last date of filing GSTR-3B returns for every taxpayer is 20th of …