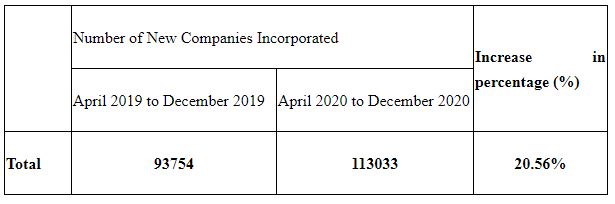

During the Financial Year 2021-22, Ministry of Corporate Affairs (MCA) registered more than 1.67 Lakh company incorporations as compared to 1.55 Lakh companies during FY 2020-21. The increase is significant considering that number of companies incorporated during Financial Year 2020-21 were the highest in any of the previous years. The incorporations during FY 2021-22 are …