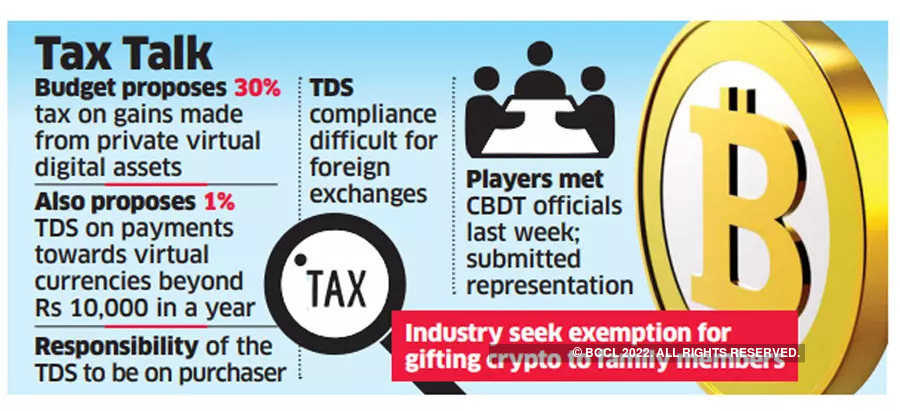

Tax saving mutual funds or Equity linked Saving Schemes (ELSS) help you to save income tax under section 80C of the Income Tax Acts. You can invest a maximum of Rs 1.5 Lakh in ELSSs and claim tax deductions on your investments every financial year. Are you Interested? Before procedding further, you should first familiarise …