The Cryptocurrency industry has appealed to the government to reexamine the budget proposal to impose a tax deduction at source or TDS on virtual digital assests transactions, saying it will be difficult to comply with.

The industries also urged the government to reconsider the decision to levy a tax of 30% on currency market value when crypto assets are gifted or given to employees as a part of their remuneration, saying the tax is lavied without waiting for the receiver to sell it and book any profit.

These issues figured when representatives of leading domestic crypto exchanges met with finance ministry officials on Friday to discuss budget proposals, people familiar with the deliberations told economics times.

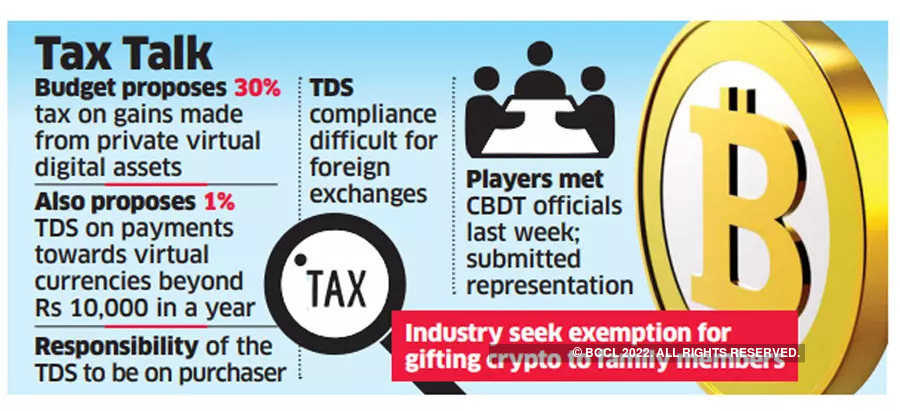

Finance minister Nirmala Sitharaman has proposed a 30% tax on gains made from any private virtual digital assets from April 1. The budget has also proposed a 1% TDS on payments towards virtual currencies beyond Rs 10,000 in a year and taxation of such gifts in the hands of the recipient.

Many experts said crypto taxation required more discussion before implementation as the current proposals lack clarity on various issues.

They are not banning crypto but killing it with tax compliance, a crypto industry officials told economics times on condition of anonymity. TDS is technically not feasible as tracking down identity become difficult.

Responsibility of paying 1% TDS lies with the purchaser at the time of payment. this would be difficult to comply with in situations where assets are being bought from a non-resident seller and domestic exchange only facilitates supply from an overseas exchange, the person said.

There is also a lack of clarity on how it will apply in various other situations, like for example, when there is an exchange of one kind of crypto asset with another without any cash, industry insiders said.

They have also sought clarity on transactions with residents of a country with which india has a double taxation avoidance agreement.

The industry also want wants clarity on issues including in whose favour will TDS be deducted and who would be the country party as foreign exchnages will not reveal the identity of sellers, making compliance difficult.

The introduction of crypto tax under the income-tax regime is nothing less than a knee jerk reaction to tax a fast-building pareller ecosystem currency.