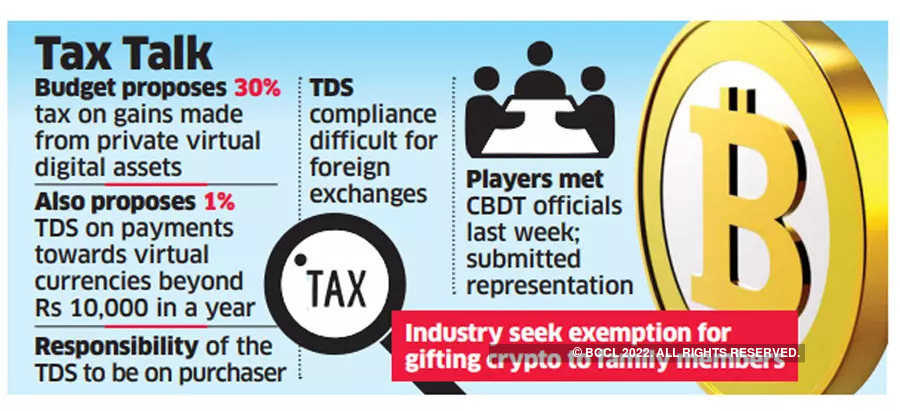

The Cryptocurrency industry has appealed to the government to reexamine the budget proposal to impose a tax deduction at source or TDS on virtual digital assests transactions, saying it will be difficult to comply with. The industries also urged the government to reconsider the decision to levy a tax of 30% on currency market value …