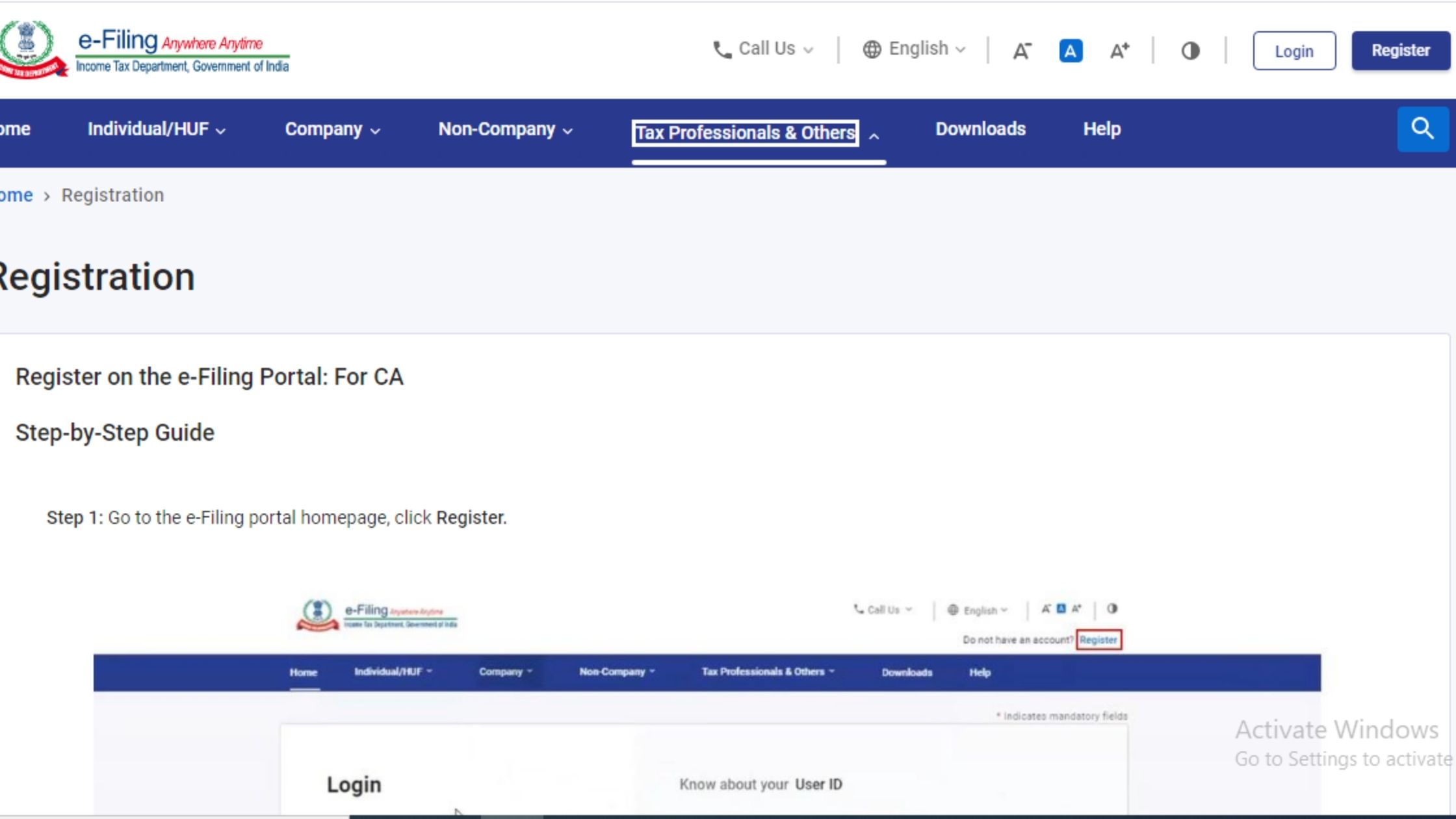

On consideration of difficulties reported by the taxpayers and other stakeholders due to COVID and in electronic filing of various reports of audit under the provisions of the Income-tax Act,1961 (Act), the Central Board of Direct Taxes (CBDT), in exercise of its powers under Section 119 of the Act, provides relaxation in respect ofthe following …