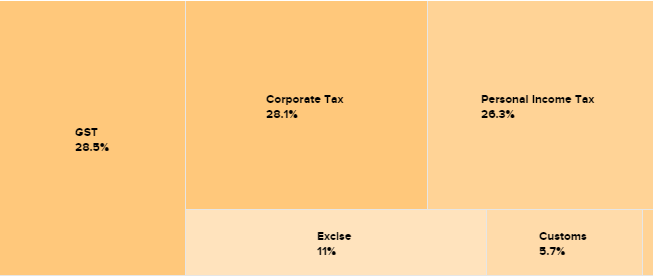

With the implementation of GST, 2017 saw a complete change in the way we used to pay our taxes. Scroll down for more details on how the government of India gets it money and pick the trend you want to see: personal income tax, corporate taxes, service tax, excise or customs duties. SOURCES OF REVENUE …