The 38th meeting of the GST Council met under the Chairmanship of the Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman here today. The meeting was also attended by the Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Finance Ministers of States & UTs and senior officers of Ministry of Finance.

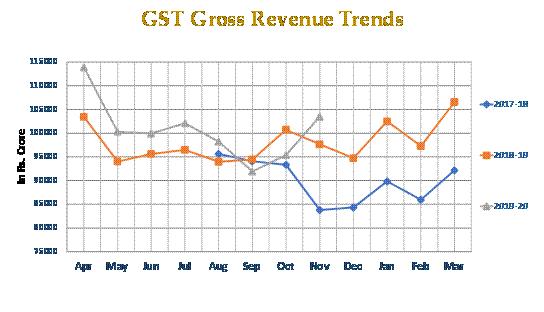

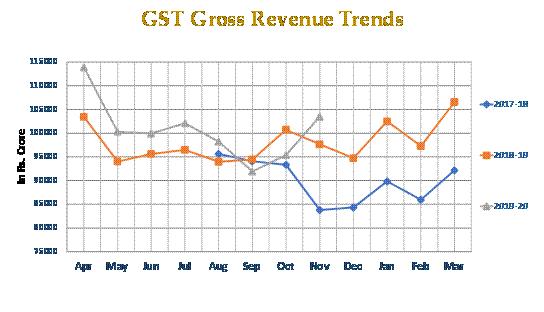

A presentation was made to the 38thGST Council on the issue of revenue, GST rate structure and compensation needs of the States. Before the presentation, the Convenor of GoM on revenue augmentation Sh. Sushil Kumar Modi, Dy CM (Bihar) made opening remarks about the revenue position and future roadmap. The presentation made thereafter was based on discussions in the Committee of officers of State and Centre on revenue augmentation. The revenue trends since inception of GST as shown below was taken note of –

A constructive discussion followed the presentation covered a wide range of issues such as measures for encouraging voluntary compliance, expanding tax base, measures to improve return filing and tax collection and rate rationalisation. Automation measures such as e-invoice, new return system, QR code on bills were also discussed. To exchange knowledge about best practices of tax administration, State of UP and UT of J&K made presentation on their effort to improve GST collection, as in the recent past they have shown a healthy growth in compliance.

GST Council gave necessary guidance on further analysis regarding exemption and concession impact analysis, tax base analysis, sensitivity analysis and compliance measures needed to keep pace with revenue needs. The Council also directed for expeditious implementation of IT and other initiatives.