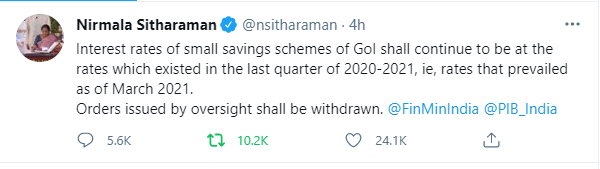

The government announced a reduction in the interest rates of all small savings schemes like PPF, Sukanya Samriddhi on 31 March, and the decision has been withdrawn today. Finance Minister Nirmala Sitharaman has given information about this decision of the government from her own Twitter account. The Finance Minister has written that the interest on small savings schemes of the Government of India will continue to be available at the same rate that was available in the last quarter of 2020-21. That is, the interest that was being received till March 2021, the same interest will continue to be received even further. Orders issued yesterday are withdrawn.

Relief for senior citizens also

Let us tell you that the government notifies Small Saving Scheme every quarter. On Wednesday, the government had revised the interest rates for the first quarter of the financial year 2021-22 i.e. from April 1 to June 30, 2021. The government on Wednesday also reduced the interest rates of the five-year Senior Citizens Savings Scheme by 0.9% to 6.5%. However, now the old interest rate will be applicable only.

Interest rates on Sukanya Samriddhi will continue to be applicable.

For the first time, the interest rate of savings deposit was reduced by 0.5% annually to 3.5% per annum, earlier it was available at the rate of 4% per annum, now it will continue to be available at the same rate. On Wednesday, the interest on the savings scheme for girls Sukanya Samriddhi Yojana (SSY Interest Rate) account was reduced by 0.7 percent to 6.9 percent for the first quarter of 2021-22.

Kisan Vikas Patra

The annual interest rate on Kisan Vikas Patra Interest Rate was reduced by 0.7 percent to 6.2 percent. Now it will continue to get 6.9 percent interest as before, the Finance Ministry announced in 2016 that the interest rate will be fixed on a quarterly basis, and said that the interest on small savings schemes will be linked to the returns of government bonds.