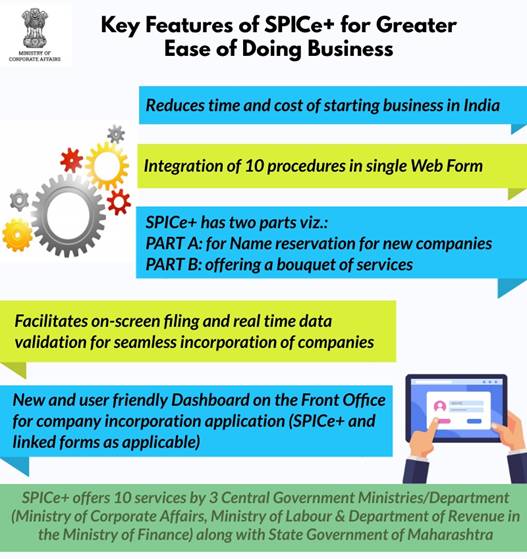

KEY HIGHLIGHTS ü Rs 40,000 crore increase in allocation for MGNREGS to provide employment boost ü Increased investments in Public Health and other health reforms to prepare India for future pandemics ü Technology Driven Education with Equity post-COVID ü Further enhancement of Ease of Doing Business through IBC related measures ü Decriminalisation of Companies Act defaults ü Ease of Doing Business …