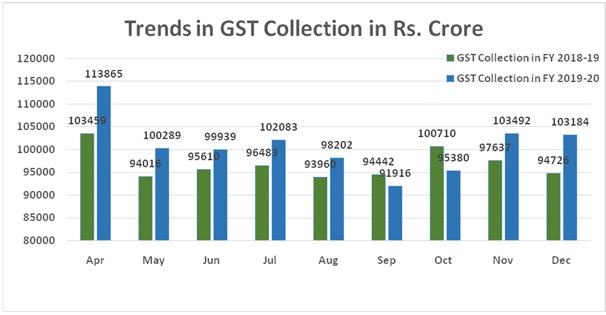

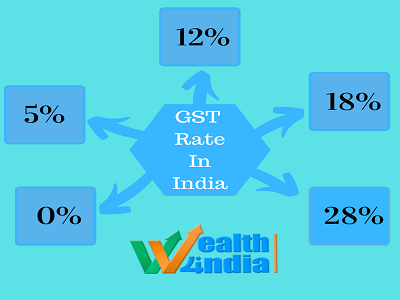

Now there will be 20, 22 and 24 deadlines for three different categories of taxpayers. The central government has given a big relief to small businessmen doing business of less than 5 crore. It has been decided to extend the last date for filing Goods and Services Tax (GST) by four more days. In the …