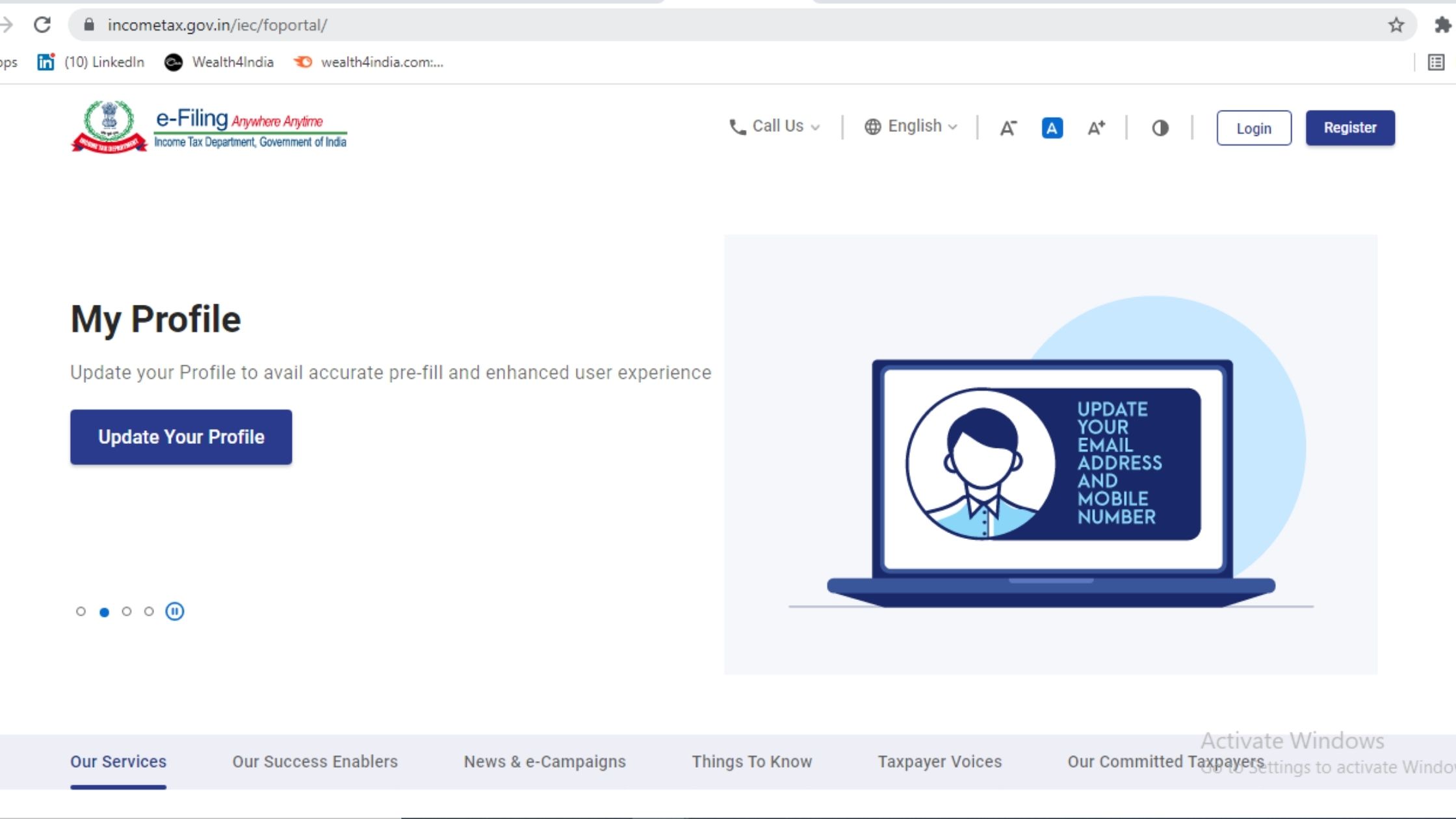

The Income Tax Department has launched its new portal e-filing 2.0 on Monday. Which is more user friendly than before, taxpayers themselves can easily file their tax returns, check refund status as well as make tax payments. Taxpayers update their personal details The Income Tax Department has asked the taxpayers to re-register their DSC immediately …