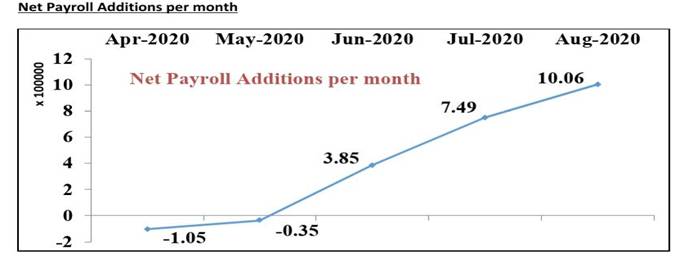

Government efforts to revive the economy after the lockdown opens, seem to be getting results. Earlier in October too, the GST collection was Rs 1,05,155 crore. In the midst of the Corona crisis, good news has come for the government for the second consecutive month on the economic front. The collection of Goods and Services …