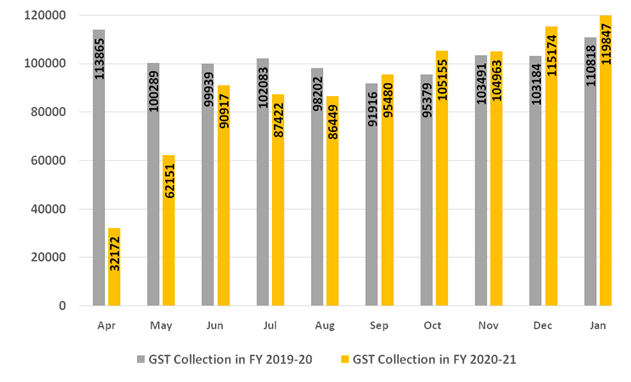

The gross GST revenue collected in the month of January 2021till 6PM on 31.01.2021 is ₹ 1,19,847 crore of which CGST is ₹ 21,923 crore, SGST is ₹ 29,014 crore, IGST is ₹ 60,288 crore (including ₹ 27,424 crore collected on import of goods) and Cess is ₹ 8,622 crore (including ₹ 883crore collected on import of goods). The total number of GSTR-3B …