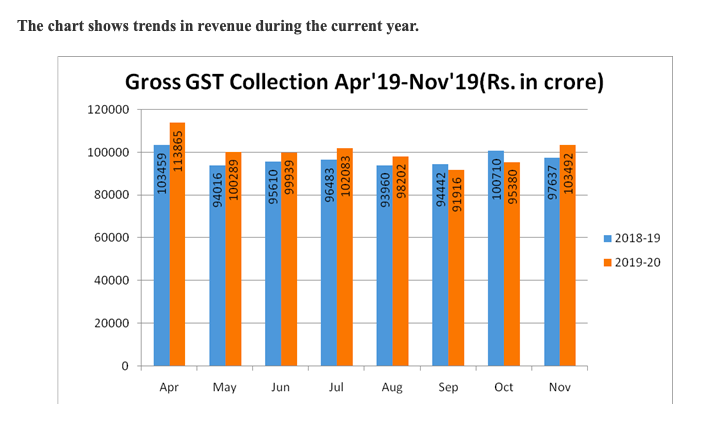

The 38th meeting of the GST Council met under the Chairmanship of the Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman here today. The meeting was also attended by the Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Finance Ministers of States & UTs and senior officers of Ministry …