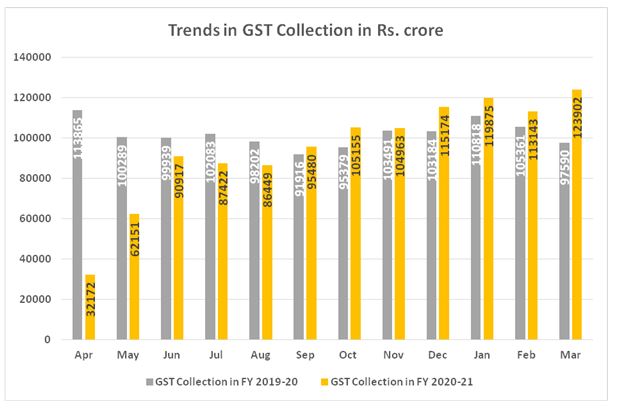

After the covid-19 crisis, the country’s economy is gaining momentum. This is confirmed by the March GST collection figures, which are 27% higher than in March 2020. Received 1.23 Lakh Crore Revenue According to the data of the Finance Ministry, the government received a gross GST revenue of Rs 1,23,902 crore in March 2021. Of …