Salaried Income tax Return File

Are you a salaried individual with an income below Rs. 50 lacs and finding the process of filing your Income Tax Return (ITR) overwhelming? Wealth4India is here to help! Our expert ITR filing services are designed specifically for salaried individuals, ensuring a seamless, convenient, and hassle-free experience. Let us simplify your tax filing process, so you can focus on what matters most.

This version aims to be more engaging and emphasizes the ease and expertise provided by Wealth4India in handling the ITR filing process for salaried individuals.

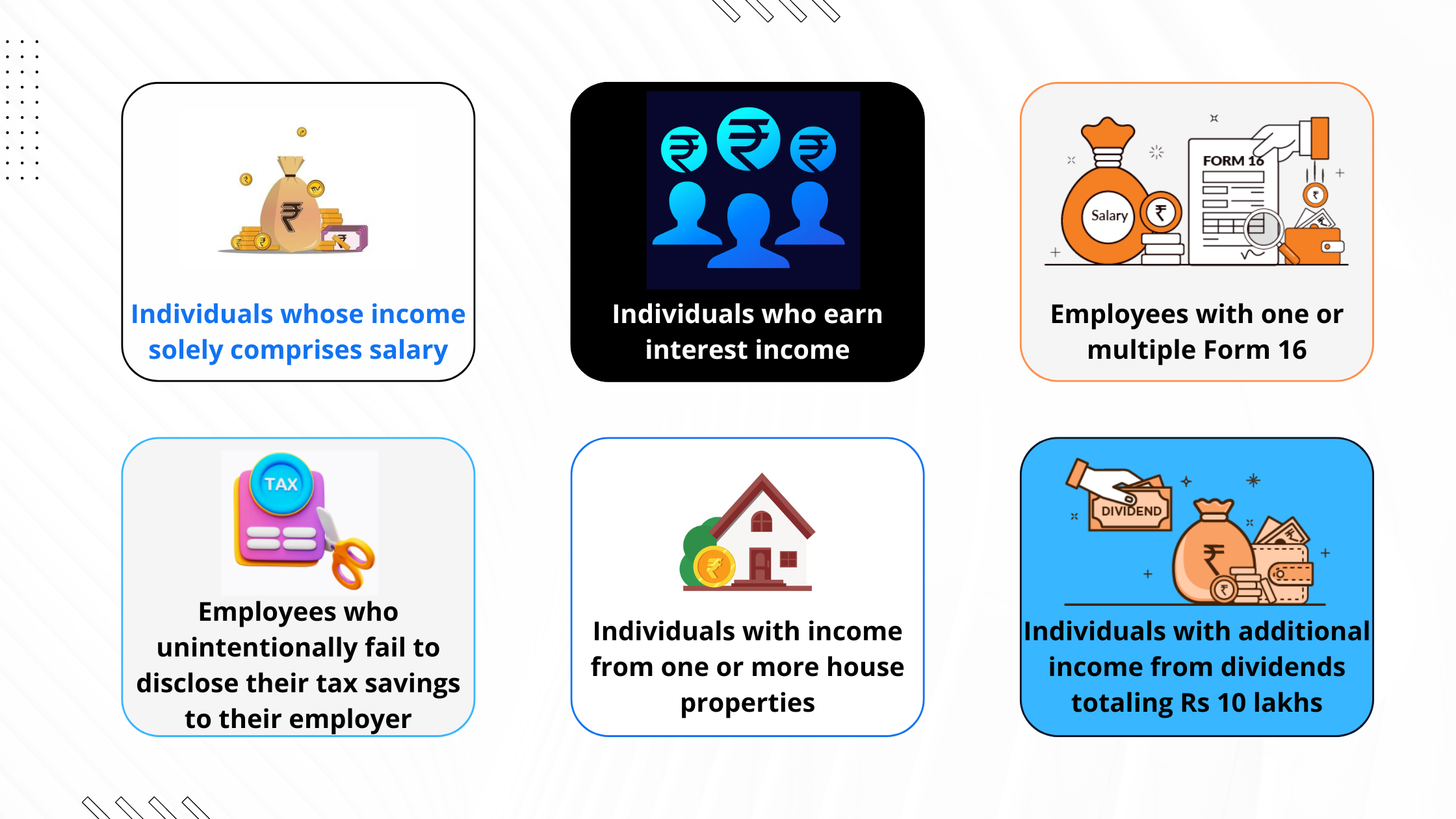

Key features for Salaried Individual ITR Filing

Wealth4India offers expert ITR filing services for salaried individuals with income below Rs. 50 lacs, whether you have a single or multiple Form 16s. Our comprehensive services include:

- Choosing the most beneficial tax regime.

- Reporting income from house property

- Declaring interest and dividend income

- Maximizing exemptions, allowances, and deductions

- Managing tax payments and refunds

- Access to Wealth4India’s income tax expert consultation

Document Required

- Copy of PAN Card

- Copy of Aadhaar Card

- Bank account information

- Email address and phone number

- Form 16 (Income Tax Certificate)

- Form 26AS (Tax Credit Statement)

- Home loan interest statement

- Interest statement

- House rent details

- Bank statements

- Receipts for tax deductions

Plan Applicable for:-

This plan is not applicable.

Individuals earning over Rs. 50 lakhs in income

- Non-resident Indians (NRIs)

- Individuals earning income from capital gains

- Individuals serving as directors in companies

- Shareholders in companies

- Individuals earning dividend income exceeding Rs. 10 lakhs