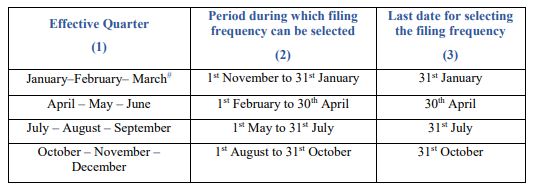

Q 1: What is QRMP scheme? What are its benefit? A: Quarterly Return, Monthly Payment of Taxes (QRMP) Scheme is a scheme to simplify compliance for small taxpayers. Under this scheme, taxpayers having an aggregate turnover at PAN level up to Rs. 5 crore can opt for quarterly GSTR-1 and GSTR-3B filing. Payment can be …