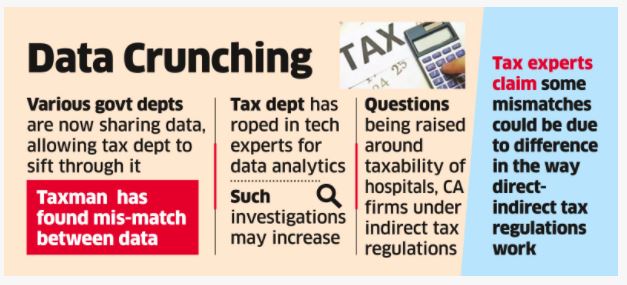

Chartered accountant firms and hospitals are under scrutiny after the revenue department found mismatches between their income tax and indirect tax filings. Tax authorities have also decided to slot consultant doctors as ‘intermediaries’ for taxation purposes even as medical services are outside the purview of goods and services tax (GST), people aware of the development …